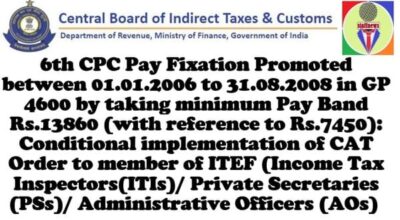

6th CPC Pay Fixation promoted between 01.01.2006 to 31.08.2008 in GP 4600: Conditional implementation of CAT Order to member of ITEF (ITIs/PSs/AOs) |

6th CPC Pay Fixation promoted between 01.01.2006 to 31.08.2008 in GP 4600 by taking minimum Pay Band Rs.13860 (with reference to R.s7450): Conditional implementation of CAT Order to member of ITEF (Income Tax Inspectors(ITIs)/ Private Secretaries (PSs)/ Administrative Officers (AOs)

Office of the Pr. Chief Commissioner of Income Tax,

Andhra Pradesh & Telangana, Hyderabad

10th floor, Income Tax Towers

A.C.Guards, Hyderabad-500004

F.No.Pr.CCIT/AP&TS/Estt./OA No.10950f2014/2022-23

Date:18.01.2023

To

All the Heads of Department/ Heads of Offices

In Andhra Pradesh & Telangana Region.

Sir/Madam,

Sub: implementation of Hon’ble Central Administrative Tribunal, Pr. Bench, New Delhi Order dated 01.06.2006 in OA No.1095/2014 in the case of K.P.Rajagopal and Ors Vs Union of India Subject to outcome of W.P.No.3527/2019 filed by UOI before Hon’ble High Court of New Delhi — Regarding.

Ref: DIT(HRD), CBDT,New Delhi’s letter in F.No.HRD/CM/175/9/2010- 11/7500, dated 27.12.2022.

***

Kind reference is invited to the above.

I am directed to forward herewith the letter referred above received from O/o DIT(HRD), CBDT, New Delhi for implementation of the direction issued therein.

Further, I am directed to request that an additional remarks in the Pay Fixation Statement may be made with regard to the communication that the matter has been contested before Hon’ble High Court of New Delhi as under:

“The above fixation is subject to the outcome of the decision of Hon’ble High Court of New Dethi on the Writ Petition filed by the department vide no.3527/2019 and subsequent petition filed in future, if any and resultant recovery on account of enhanced pay and allowances drawn by giving effect to this fixation.”

Yours faithfully,

(THAMBA MAHENDRA)

Deputy Commissioner of Income tax

(H.Qrs.)(Admn.)

O/o Pr. CCIT, AP&TS, Hyderabad

Encl: as above.

GOVERNMENT OF INDIA

DIRECTORATE OF INCOME TAX

HUMAN RESOURCE DEVELOPMENT

CENTRAL BOARD OF DIRECT TAXES

F. No. HRD/CM/175/9/2010-11/7500

27 DEC 2022

To,

The Pr. CCsIT (CCA)

All Charges

Madam/ Sir,

Sub: Implementation of Hon’ble CAT Pr. Bench, New Delhi Order dated 01.06.2016 in OA No. 1095/2014 in the case of Shri KP Rajgopal and Ors vs Union of India subject to outcome of WP No. 3527/2019 filed by Uol in Hon’ble High Court of Delhi- reg.-

Kindly refer to the above.

In the Income Tax Department, consequent to the acceptance of recommendation of 6th CPC and implementation of CCS(Revised Pay) Rules 2008, the Income Tax Inspectors(ITIs)/ Private Secretaries (PSs)/ Administrative Officers (AOs) were initially placed in the running Pay Band-2 of Rs. 9300-34800 with Grade Pay of 4200. Further, vide the OM from F.No. 1/1/2008-IC dated 13.11.2009, replacement pay structure of Grade Pay 4200 in Pay Band-2 was granted Grade Pay of Rs. 4600 in the Pay Band-2. The Department of Expenditure (DoE) vide U.O. No. 10/1/2009-IC dated 14.12.2009 prescribed the manner of fixation of pay of Assistant/ PA of CSS and CSSS respectively. Accordingly, the officials promoted to the post of ITIs/ PSs/AOs in the Department of Income Tax between 01.01.2006 to 31.08.2008 also got their pay fixation in the manner prescribed vide DoE U.O. No. 10/1/2009-IC dated 14.12.2009. However, the Department of Expenditure vide its U.O. No. 123008/E-III(A)/2013 dated 16.07.2013 has clarified that the extension of provision of DoE’s U.O.No. 10/1/2009-IC dated 14.12.2009 to the ITIs/ PSs/ AOs of the Income Tax Department who were promoted between 1.1.2006 and 31.8.2008 as allowed to Assistant/ PA of CSS/CSSS has been re-examined and has not been found possible to extend it to the ITIs/PSs/ AOs of Income Tax Department.

3. Aggrieved by the clarification made vide U.O. No. 123008/E-III(A)/2013 dated 16.07.2013, Mr. KP Rajgopal, Secretary General of ITEF and SMT. Kusum Lata Panwar Inspector of Income Tax, New Delhi have approached the Hon’ble CAT, PB, New Delhi Vide OA No. 1095/2014 seeking following reliefs:

(i) That the Dol: U.O.No. 123008/1:-IT(A)/2013 dated 16.07.2013 may kindly be set aside.

(ii) That the clarification at (c) in DoE IC U.O. No. 10/1/2009-IC dated 14.12.2009 may kindly be made applicable to ITIs/PSs/AOs in Income ‘Tax Department who had been promoted between 01.01.2006 and 31.08.2008.

(iii) That since the Grade Pay of Rs. 4600 in PB-2 corresponding to pre-revised pay scale of Rs. 7450-11500 has been granted with effect from 1.1.2006, the pay of ITIs/PSs/AOs in Income Tax may be fixed in terms of provisions of Rule 7 of CCS(Revised Pay) Rules 2008 taking minimum pay on pay band as Rs. 13860 (with reference to Rs. 7450) and not Rs. 12090 (with reference to 6500).

(iv) That these remedies are made available to all other cadres of employees in all Departments whose grade pay was upgraded to grade pay of Rs. 4600 in PB-2 in terms – of Department of Expenditure OM No. 1/1/1980-IC dated 13.11.1989.

(v) Any other relief which the Tribunal considers appropriate in circumstances of the case.

4. The Hon’ble CAT, PB, New Delhi has allowed the OA filed by the applicants vide its order dated 01.06.2016. The operative portion of the order is as under;

“59. Therefore, we find merit in the OA and the Annexure A-1, as issued declining the revision of pay scales to be opted from the date of first substantive promotion by those who were promoted between 01.01.2006 and 31.08.2008 is held to be illegal and is set aside.

60. In the result, the OA is allowed with the above observations, but there shall be no order as to costs”

5. Considering the above facts, the department has considered the order of Hon’ble CAT dated 01.06.2016 and it has been decided to contest the order before the Hon’ble High Court of Delhi. Accordingly, WP No. 3527/2019 is pending before Hon’ble High Court of Delhi. However, in consultation of DoE and DoLA, it has been decided to implement the order of Hon’ble CAT dated 01.06.2016 as per the operative portion of the order reproduced at para 4 subject to the outcome of WP No. 3527/2019. Accordingly, the effect of the order dated 01.06.2016 in OA No. 1095/2014 of Hon’ble CAT, PB, Delhi is to be given to all affected officials who were members of the ITEF and eligible for the benefit.

This issues with the approval of competent authority.

Yours faithfully,

(DIWAKAR SINGH)

Joint Director of Income Tax

CMD-2,HRD, New Delhi

Comments