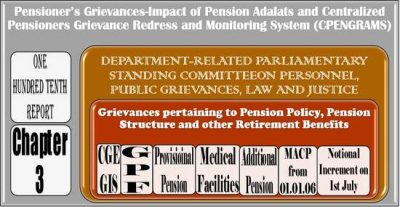

Grievances pertaining to Pension Policy, Pension Structure and other Retirement Benefits: Chapter 3 of 110th Report of Parliamentary Committee on Pensioner’s Grievances | StaffNews

Grievances pertaining to Pension Policy, Pension Structure and other Retirement Benefits: Chapter 3 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

CHAPTER 3

Grievances pertaining to Pension Policy, Pension Structure and other Retirement Benefits

3.0 The Committee held its second meeting on 4th January, 2021 during which it heard the Secretary, Central Government Pensioners’ Welfare Association followed by the Secretary, Department of Pension and Pensioners’ Welfare and Controller General of Accounts, Ministry of Finance. During the meeting, the Committee discussed specific grievances relating to pension policy, pension structure and pension procedure among others.

CENTRAL GOVERNMENT EMPLOYEES’ GROUP INSURANCE SCHEME (CGEGIS)

3.1. The Central Government Employees’ Group Insurance Scheme (CGEGIS), a group insurance scheme, exclusively meant for the Central Government Employees came into force w.e.f. 01st January, 1982. It is a self-financing and self-supporting Scheme without any financial assistance from the Government. The scheme was launched with the twin objectives of providing insurance cover to their families in the event of death in service and providing lumpsum payment to augment their resources on retirement. The subscription paid by members towards the Scheme is recovered every month from their salary and bifurcated into 2 funds, namely – ‘Savings Fund’ and an ‘Insurance Fund’ in the ratio 70:30.

Read also: Standing Committee Report Summary on Pension Grievances: Recommendations on CPENGRAMS, CGEGIS, Additional Pension, Medical Facilities, Provisional Pension & Family Pension

3.2. The Committee was informed that the rate of subscription per unit is fixed at Rs. 15/- per month since 01.01.1990. A Group ‘C’ employee has to subscribe for two units, a Group ‘B’ employee for four units and a Group ‘A’ employee for eight units. The amount of insurance cover is Rs. 15,000/- for each unit of subscription of Rs. 15 per month. It will be paid to families of those ’employees’ who unfortunately die due to any cause while in service. Thus, the maximum insurance cover for Group ‘A’ employees stands at Rs.1,20,000; for Group ‘B’ at Rs. 60,000 and for Group ‘C’ at Rs. 30,000. Ministry of Finance publishes ‘Table of Benefits’ and the total amount is worked out using the same depending upon when the employee joined the Scheme and the year/ month of cessation of membership. Upon employee’s exit from the Scheme, only the Savings amount, as applicable on the concerned date, is payable. In case of demise of the employee, the Savings amount applicable on the date plus the insured amount is payable.

3.3. The Committee is of the view that the benefits provided by social security systems should improve quality of life, support independence and compensate for the loss of income after retirement. As regards CGEGIS, the Committee notes that the monthly deduction as well as the insurance amount have remained unchanged since 1990. In the present context, the insurance cover provided by CGEGIS seems to be too meagre to be commensurate with the elevated cost of living. Therefore, the Committee recommends the Government to implement the recommendations of Seventh Central Pay Commission and increase the Insurance amount to Rs. 50,00,000, Rs. 25,00,000 and Rs.15,00,000 for Group ‘A’, ‘B’ and C officers/ staff respectively with commensurate enhancement in monthly contribution of Rs. 5000, Rs. 2500 and Rs. 1500 for respective Groups of officers/ staff.

3.4 The Committee takes note of the fact that India has been undergoing rapid demographic changes over the last three decades. The mortality and morbidity rates have also changed remarkably. The Committee also notes that the ‘Table of Benefits’ published by the Ministry of Finance is based on the mortality rate of 3.75 per thousand per annum upto 31.12.1987 and 3.60 per thousand per annum thereafter. Therefore, the Committee is of the opinion that there is a need to review the current mortality rate and accordingly revise the apportionment between the Savings and Insurance funds. The Committee agrees with the observation made by the Seventh Central Pay Commission in this regard and recommends that the ratio of Savings Fund to Insurance Fund be modified from the present 70:30 to 75:25 at the earliest.

GENERAL PROVIDENT FUND (GPF)

3.5. General Provident Fund (GPF) Scheme came into effect from 01st April, 1960 and is applicable to Government servants who were appointed before 1st January, 2004 and are covered by the Defined Benefit Pension Scheme (Central Civil Services (Pension) Rules, 1972). The Government servants appointed on or after 1st January, 2004 are covered by the National Pension System and are not eligible to subscribe to the GPF.As per the rules, all temporary/permanent Government servants appointed before 1.1.2004 and not contributing to any other Provident Fund (e.g. Contributory Provident Fund) have to compulsorily subscribe to the General Provident Fund.

3.6 The GPF Scheme was introduced mainly to foster the habit of savings amongst the Government employees and to provide them financial help in times of need. Under this Scheme, monthly subscription is fixed by the subscriber himself subject to the condition that it will not be less than 6% of his basic pay and not more than his basic pay. Central Government credits annual interest in the account of subscriber each year as per the rate of interest decided in that financial year. When a subscriber retires or quits the service, the amount standing to his credit in the Fund becomes payable to him.

3.7. The Committee notes that GP Fund is one of the most popular and reliable savings funds amongst Government employees for it can be relied upon in times of need while in service or after retirement. This also ensures that the Government employee has a substantial amount in his bank account to meet any unforeseen expenditure after his/ her retirement.

3.8 The Committee was informed that the major grievances with respect to GPF from Pensioners’ are inaccurate and delayed GPF settlement, along with interest on their retirement, due to frequent instances of missing credits in their GPF accounts reported mostly by subscribers, who during their service moved from one establishment to another or were assigned foreign deputation and also by Officers of All India Services, who proceed on deputation outside their cadres. The Department informed that the situation of missing credit arises mainly in cases where the GPF account is maintained by an establishment different from that generating their salary bills and deducting their GPF subscription. The Committee was further informed that to avoid such grievances, the Department of Pensions and Pensioners’ Welfare vide OM No. 3/7/2020-P&AO dated 17th July, 2020 has issued instructions making it mandatory for all offices maintaining GPF accounts to intimate the particulars of missing credits, once in every financial year, to the authority responsible for deducting the GPF subscription, under intimation to the concerned subscriber. Further, a complete statement of all credits, debits and interest since inception of the GPF account is to be provided to every subscriber, mandatorily two years before the date of retirement and seek representation, if any, within 60 days from the receipt of such a statement.

3.9. Since the amount deposited in GPF Account is mainly the monthly contribution made by a Government employee while in service, it is expected that they should be paid the deposited amount along with interest in one sum on the day of exit from the Fund consequent to retirement/ resignation. The Committee notes that despite having integrated structure of GP Fund Account, All India Services Officers and other Officials in transferable establishments are subjected to opening of separate GP Fund account at each place of posting in course of their service which leads to creation of multiple GPF accounts for the same person over a period of time or when the borrowing organization fails to send the monthly GPF contribution deducted from the subscriber to his/ her parent office where GPF account is maintained subsequently give rise to the issue of missing credit. The existence of multiple GPF accounts or absence of transfer of deposit to the establishment where GPF account of a subscriber is maintained often poses problems in need-based withdrawal from the Fund while in service or after exit from GPF Scheme consequent to the retirement.

3.10. The Committee is appreciative of the remedial action taken by the Department of Pension and Pensioners’ Welfare to resolve GPF related grievances of pensioners vide their OM dated 17th July, 2020 and expects that the same would help in the regular updation of GPF account and in addressing the issue of missing credit. The Committee further observes that in this era of digitization and online banking, Government accounting system operates as an integrated unit. The Committee, accordingly, recommends that the extant practice of opening multiple GPF accounts by an employee in transferable establishment should be done away with and that only single GPF account should be in operation throughout the duration of his/ her service. Further, if a Government servant is posted in an Establishment where GPF Rules are not applicable, the monthly deposit in the Fund should be made from the salary of the subscriber and transferred by the borrowing organization to his/ her parent department where his/her GPF account is maintained through electronic mode under intimation to the subscriber.

Provisional Pension

3.11. There are the following two rules in the Central Civil Services (Pension) Rules, 1972 for sanction of provisional pension to a retired Government servant:

(i) Rule 64: In cases where, in spite of following the procedure, the Head of Office is not able to forward the pension papers to the Accounts Officer within the specified period or the pension papers are returned by the Accounts Officer to the Head of Office for eliciting further information and the Government servant is likely to retire before authorization of pension, the Head of Office is required to issue a sanction letter authorizing 100% of pension and gratuity as provisional pension and provisional gratuity, withholding 10% gratuity for unassessed Government dues.

(ii) The above instructions further provide that the provisional pension and provisional gratuity may be sanctioned in those cases also, where retiring Government servant is unable to submit the pension claim Forms for any reason. These instructions are also applicable in cases where the Government servant retires otherwise than on superannuation, i.e. voluntary retirement, retirement under FR 56, etc.

(iii) Rule 69 read with Rule 9(4): In cases where any departmental or judicial proceedings are pending against a Government servant at the time of retirement, a provisional pension, equal to maximum pension which would have been admissible on the basis of qualifying service up to the date of retirement of the Government servant, is required to be sanctioned by the Accounts Officer. The provisional pension is payable till the issue of final orders after the conclusion of the departmental or judicial proceedings. No gratuity is payable till the conclusion of the departmental or judicial proceedings and issue of final orders thereon.

(iv) Rule 80-A provides for sanction of provisional family pension in case of death of a Government servant while in service. Under this rule, after the family pension case has been sent by the Head of Office to the Accounts Officer, the Head of Office is required to issue a sanction letter authorizing the provisional pension not exceeding maximum family pension and provisional gratuity equal to 100% of the amount of death gratuity admissible. In order to avoid any hardship to the family of the deceased Government servant, Department of Pension & PW has issued instructions vide OM No. 1/11/2020-P&PW(E) dated 29th July, 2020 relaxing the provisions of rule 80-A of the CCS (Pension) Rules, 1972 to the extent that if a claim for family pension in Form 14 along with death certificate and bank account details of the claimant has been received and the Head of Office is satisfied about the bonafide of that claim, he shall sanction provisional family pension immediately. The Head of Office shall not wait for forwarding of the family pension case to Pay & Accounts Office before sanctioning the provisional family pension.

3.12. The Committee desires that retirees should not be regarded as recipients of welfare dole but as the claimants of their rightful entitlements. As per the extant instructions laid down under Rule 64 of the CCS (Pension) Rules,1972, the payment of provisional pension will initially continue for a period not exceeding six months from the date of retirement. The period of provisional pension may be further extended, in exceptional cases, with the concurrence of PAO and after approval by the Head of Department. However, the total period of provisional pension shall, in no case, be more than one year from the date of retirement. The Committee believes that every retiree should have a basic right to get “provisional” pension till their regular Pension Payment Order (PPO) is issued and other procedural formalities are completed. The Committee recommends that the Government may consider payment of “Provisional Pension” until the final pension is sanctioned to the retired Government servant.

3.13 It was brought to the notice of the Committee that ongoing pandemic has further caused delay in disbursal of pensionary benefits to employees who got retired during this pandemic as they faced difficulties in submitting their Pension Forms to the Head of Office or furnishing the hard copy of Claim Form along with Service Book to the concerned Pay and Accounts Office in time. The retiree belonging to Central Armed Police Forces (CAPFs) who usually are posted at different locations and whose Heads of Offices sit in offices of cities different from where their Pay and Accounts Office is located, faced more difficulties during this period.

The Department should intervene in the matter and come up with a viable solution and apprise the Committee in this regard.

Read also: Introduction – Category of Pensioners : Chapter 1 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

Grievances relating to Medical Facilities

3.14. Pensioners’ associations have brought certain grievances pertaining to the medical facilities to the notice of the Committee, the details of which are furnished below :-

(i) The Apex Court has given decision in a number of cases that all the expenditure incurred by a beneficiary of Central Government Health Scheme on his or her treatment in non-empanelled Private Hospitals should be reimbursed to the beneficiary. However, the Government has not issued any general instructions in this regard with the result all such pensioners/beneficiaries have to approach the Court of law for justice by spending a lot of money and time.

(ii) The medical facilities and attention to the critically ill pensioners require urgent attention of the authorities. CGHS confines its operations to Delhi/NCR, state capitals and a few large urban centres. There are a large number of nodal points where many central government staff work and settle down after retirement. Establishment of CGHS Wellness centres at more district locations will go a long way in catering to such pensioners. The monitoring of medical attention to the pensioners may also be included in ambit of the CPENGRAMS. At par medical facilities in all Central Govt. health schemes for pensioners needs to be ensured.

(iii) Fixed Medical Allowance may be enhanced from Rs 1000 to Rs 3000 per month since most pensioners are suffering from different diseases at old age and are unable to manage with meagre pension as CGHS hospital is not available in every town.

(iv) Pensioners having pension accounts in some Banks like SBI face difficulty in surrendering Fixed Medical Allowance (FMA) and getting FMA Surrender Certificate to avail CGHS indoor & outdoor (OPD) facilities, due to their insisting on directions from CPAO which is very cumbersome and long drawn process through the parent dept. and concerned PAO. Such Pension Disbursing Authorities (PDAs) can very easily facilitate surrender of FMA to the pensioners on request, as no FMA or other allowance amount is mentioned in PPOs issued by CPAO. Only ‘as admissible’ is recorded there. Clear instructions to all PDAs may be issued in this regard, so that all such pensioners can get hassle free FMA Surrender Certificates to avail CGHS facilities to which they are entitled after paying subscription to the Central Govt. Health Scheme (CGHS).

3.15. Regarding reimbursement of expenditure incurred by a beneficiary of Central Government Health Scheme on his or her treatment in non-empanelled Private Hospitals, DoPPW has clarified that the matter of reimbursement of medical expenses of serving employees and pensioners comes under the administrative purview of Ministry of Health and Family Welfare. All instructions are issued by the administrative ministry after examining the judgment of the Court and in consultation with other concerned Departments e.g. Ministry of Law and Justice and Ministry of Finance etc. The Department has assured the Committee that this suggestion of the Associations shall be conveyed to the Ministry of Health and Family Welfare.

3.16. Regarding the establishment of CGHS wellness centre and expansion of CGHS Network, DoPPW has clarified in its submission that it comes under the purview of Ministry of Health and Family Welfare. Such decisions are taken by Ministry of Health and Family Welfare based on their guidelines and availability of resources. However, this suggestion of the Associations shall be conveyed to the Ministry of Health and Family Welfare.

3.17. In regard to enhancement of Fixed Medical Allowance granted to pensioners, who reside outside the CGHS areas, for meeting expenditure on day to day medical expenses (OPD) that do not require hospitalization, the DoPPW has stated that the amount of Fixed Medical Allowance was increased from Rs. 300/- per month to Rs. 500/- per month vide Department of Pension & PW’s OM dated 19.11.2014. The question of increasing the amount of Fixed Medical Allowance was examined by the 7th Central Pay Commission. Since the amount of this allowance was increased to Rs. 500/- per month w.e.f. 19.11.2014, the Commission did not recommend any further enhancement of the allowance. According to DoPPW, the Committee headed by Finance Secretary was constituted to examine the recommendations of the 7th Central Pay Commission on various allowances payable to the Government employees/pensioners and the said Committee recommended enhancement of the Fixed Medical Allowance from Rs. 500/- p.m. to Rs. 1000/- per month. Accordingly, orders for enhancement of the Fixed Medical Allowance from Rs. 500/- p.m. to Rs. 1000/- per month, w.e.f. 1.7.2017, have been issued vide OM dated 19.7.2017. The Department has, however, assured that the suggestion of the Associations to further increase the same to Rs. 3000 p.m. shall be forwarded to the Department of Expenditure.

3.18. Regarding hassle free FMA Surrender Certificates, DoPPW has submitted that this pertains to the codal formalities for processing such cases in accordance with the instructions of the CPAO and the Bank Authorities, however, they have assured that this issue shall be taken up with the CPAO for examination to explore the feasibility of simplification of procedure, if required.

3.19. The Committee notes that despite favourable decision of apex Court in a number of cases, all the expenditure incurred by a beneficiary of Central Government Health Scheme on his or her treatment in non-empanelled Private Hospitals should be reimbursed to the beneficiary, the Government has not yet issued any general instructions in this regard and the pensioners/beneficiaries have to approach the Court of law for justice by spending a lot of money and time. The Committee believes that rules and procedures are just a means to achieve a larger goal i.e. welfare of pensioners and they should not become an end in themselves. Strict adherence and conformity to norms, rules and procedures might lead to a situation where strictly following these norms, rules and procedures instead of being means, become ends in themselves which create stumbling blocks in achieving mandated objectives/ends. The Committee is of the view there may be exigencies when the old age pensioners may directly approach non- empanelled hospitals for treatment without first approaching a Government hospital. They should not be deprived of their rightful entitlements under any circumstances. The Committee recommends the Department to play a pro-active role and pursue the matter with the Ministry of Health and Family welfare. The Committee also recommends the Department to seek details of action taken by the Ministry of Health and Family Welfare on the judgements of the Apex Court in this regard and furnish them to the Committee in its Action Taken Replies.

Read also: Effectiveness of CPENGRAMS and Pension Adalats – Way Forward: Chapter 2 of of 110th Report of Parliamentary Committee on Pensioner’s Grievances

3.20. The Committee is in agreement with the views of Pensioners’ Associations that CGHS should not confine its operations to metro cities, state capitals and a few large urban centres only. The Government may explore opening of CGHS centres at district locations or designate already functional Government hospitals in district headquarters as CGHS Centres to provide treatment to CGHS beneficiaries. The Government may also include settlement of medical facility related grievances of pensioners on the portal of CPENGRAMS as requested by pensioners and the DoPPW should work in tandem with Health Ministry in this regard.

3.21. The Committee takes note of the fact that Fixed Medical Allowance is granted to pensioners who reside outside the CGHS areas for meeting expenditure on day-to-day medical expenses (OPD) that do not require hospitalization. The Committee also takes note of the request of Pensioners’ Associations for enhancement of Fixed Medical Allowance from Rs 1000 to Rs 3000 per month as most pensioners are suffering from different diseases at old age and are unable to manage with meagre pension as CGHS hospital is not available in every town. The Committee recommends DoPPW to take up this issue of enhancement of Fixed Medical Allowance with the Finance Ministry as Rs 1000 is a very meagre amount for an old age pensioner and apprise the views of the Finance Ministry to the Committee in its Action Taken Replies.

3.22. The Committee takes note of the difficulties faced by pensioners in surrendering their Fixed Medical Allowance (FMA) and getting FMA Surrender Certificate to avail CGHS indoor & outdoor (OPD) facilities, and, accordingly, recommends DoPPW and CGA that the procedural loopholes coming in this way should be plugged and ensure that all such pensioners should get FMA Surrender Certificates in a hassle free manner through online mode under intimation to the bank concerned and a timeline should be fixed in this regard.

3.23. The Committee notes that the Central Government provides health care facilities for both, serving as well as, retired employees. However, the Committee observes that serving employees of central government are covered under the Central Service (Medical Attendance) Rules, 1944 (CS (MA) Rules), which provides facilities for availing medical facilities outside CGHS covered areas. However, these Rules are not applicable to pensioners, and instead pensioners residing outside CGHS covered area are entitled to Fixed Medical Allowance (FMA). The Committee is of the view that non-applicability of CS (MA) Rules to pensioners residing outside CGHS areas has placed them at disadvantaged position vis-à-vis serving employees. Accordingly, the Committee feels that either the provisions for medical facilities available to serving employees also needs to be extended to pensioners or instead of increasing FMA year after year, DoPPW may moot a proposal for introducing cashless health insurance facilities for such pensioners in nearby Private Health Centers in lieu of FMA on voluntary basis.

Additional Quantum of Pension

3.24. At present, Central Government Pensioners are entitled to receive an additional quantum of pension equivalent to 20% of basic pension on attaining the age of 80 years, 30% on attaining 85 years, 40% on attaining 90 years, 50% on attaining 95 years and 100% of on crossing 100 years.

3.25 In this regard, Pensioners’ bodies have requested that 5% additional quantum of Pension may be considered to be commenced on attaining the age of 65 years, 10% on 70 years, 15% on 75 years and 20% on 80 years.

3.26. The Department in their written submission has stated that the provision regarding additional pension/family pension on attaining the age of 80 years and above was introduced with effect from 01.01.2006 on implementation of the recommendations of the Sixth Central Pay Commission.

3.27. The Department further stated that the Commission was of the view that older pensioners/family pensioners require a better deal because their needs, especially those relating to health, increase with age. Accordingly, the pensioners/family pensioners get additional quantum of pension amounting to 20% on attaining the age of 80 years, 30% on 85 years, 40% on 90 years, 50% on 95 years and 100% on attaining the age of 100 years. This provision was examined by the 7th Central Pay Commission also. The Commission was of the view that the existing rates of additional pension and additional family pension are appropriate. The Department has, however, assured that this suggestion of the Associations shall be conveyed to the Department of Expenditure.

3.28. The Committee is very much cognizant of the social churning taking place in our society over the years. The joint family system is breaking down giving way to nuclear families. The growth of nuclear families due to geographical and social mobility have further led to rise in individualism and individualistic thinking and the generation who want to live away from shackles of joint families and patronage of elderly parents or grandparents. According to one estimate, by 2050, the share of population over the age of 60 is likely to increase significantly in the country. In view of such changes at societal level, we need to have a robust pension system for elderly which can help them survive in this world without being a burden on anyone. The Committee is of the view that the Government should sympathetically consider the demand of Pensioners’ Associations for 5% additional quantum of Pension on attaining the age of 65 years, 10% on 70 years, 15% on 75 years and 20% on 80 years to the Pensioners. The Committee recommends DoPPW to pursue vigorously with Finance Ministry and apprise the Committee of the outcome.

Enhancement of Grant-in -aid

3.29. The Pensioners Associations have also made a request for enhancement of Grant in aid admissible to identified Pensioners’ Associations from Rs. 75,000-/ per year to Rs.1,50,000/- per year.

3.30. The Department in their response has stated that this issue would be decided on the basis of justification for additional funds by the Associations considering their previous performance/fund utilization and subject to availability of resources.

3.31. The Committee is of the view that Pensioners’ associations play an instrumental role in promoting Pensioners’ Welfare besides providing a platform for the retirees to project their grievances to the concerned agencies/authorities for their overall welfare. The Committee is satisfied with the reply of the Department and hopes that additional funds will be provided to deserving associations based on their previous performance and fund utilization.

Read also: Grievances pertaining to Authorization, sanction and processing of pension: Chapter 4 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

Modified Assured Career Progression (MACP)

3.32. The Pensioners’ bodies have claimed that Modified Assured Career Progression (MACP) was awarded by the Government to its employees and pensioners in 6th Central Pay Commission from September 2008 onwards after release of 6th CPC Report. MACP assures 03 Promotions to an employee, each up gradation after completion of 10 years service. In case of non-availability of posts, Non Functional Grades (NFU) are given with financial benefit. They have mentioned that there is a demand of pre-September 2008 pensioners that MACP should be implemented w.e.f 1st January, 2006, giving relief to pensioners retiring in the intervening period i.e. from January, 2006 to August, 2008. According to them, 3rd MACP has been denied to this section of pensioners, whereas all other benefits have been given from January 2006 in terms of 6th CPC recommendations.

3.33. Besides this, Pensioners’ Associations have also submitted that increment should be given to employees who retired on 30th June after January 2006. According to them, this issue also arose after implementation of 6th CPC recommendations wherein date of Increment to all Government Employees was brought a uniform date of 1st July every year. Those employees who retired on 30th June and had served one Full Year for earning increment were denied the increment on the plea that next date of increment is 1st July. Such cases of pensioners who retired on 30th June after Jan. 2006 will be not many, in hundreds only. But they were denied the last increment even after serving one full last year of service. Government should resolve the issue in favour of such deserving pensioners. Also it is a matter of one last increment and does not pertain to very large numbers and heavy financial implications.

3.34. DoPPW in its written reply has stated that this is a policy matter and comes within the purview of the Department of Personnel and Training (DoPT). They have further stated that any decision on date of implementation of Modified Assured Progression Scheme and Grant of Increment is taken by the DoPT keeping in view various factors including the judicial dicta. However, they have assured to convey this suggestion of the Associations to DoPT.

3.35. The Committee feels that DoPPW should pursue the matter of implementation of MACP w.e.f 1st January, 2006 with DoPT as it will give relief to pensioners retiring in the intervening period i.e. from January, 2006 to August, 2008 as all other benefits were given to them from January 2006 as per 6th CPC recommendations. The Committee also recommends DOPPW to consider the case of Pensioners’ who retired on 30th June and were denied the increment on the plea that next date of retirement is 1st July.

Read also: Grievances pertaining to disbursement of pension: Chapter 5 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

War widows

3.36 The Committee received a representation from an aggrieved woman family pensioner wherein she has mentioned that certain provisions applicable to widows of paramilitary forces and civil government servants whichcause disparity in payment of liberalized full pension to widows of civil/ paramilitary forces as compared to widows of Defence Forces Personnel. As per rule, widow of a defence personnel is entitled to full pension irrespective of her remarriage status, whereas widow of a paramilitary/ civilian govt. servant gets only 30% of her applicable full liberalized pension (a huge 70% deduction) if she remarries andthis rule is applicable even when she fully supports kids from her previous marriage.

3.37 The Committee feels that widows of paramilitary/ civilian govt. servants should not be discriminated against widows of Defence forces Personnel and recommends that the Government should sympathetically consider the plight of such women and explore the feasibility of amending Central Civil Services Pension rules to enable widows of Paramilitary/Civil Government Servants get full liberalized pension at par with widows of defence personnel even after their remarriage.

Comments