Date of next increment under Rule 10 of CCS (Revised Pay) Rules 2016: Points of doubt and clarification by CGDA

Date of next increment under Rule 10 of CCS (Revised Pay) Rules 2016: Points of doubt and clarification by CGDA

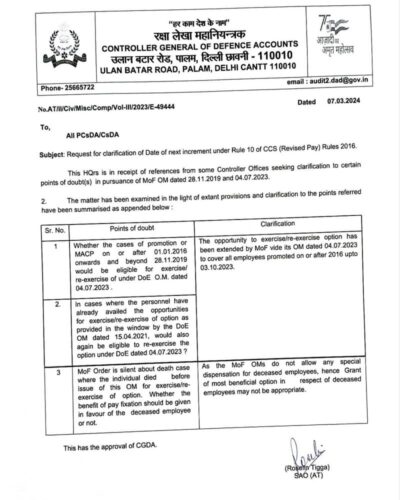

CONTROLLER GENERAL OF DEFENCE ACCOUNTS

ULAN BATAR ROAD, PALAM, DELHI CANTT 110010

No. ATIIW/Civ/Misc/Comp/Vol-Ill/2023/E-49444

Dated 07.03.2024

To,

All PCsDA/CsDA

Subject: Request for clarification of Date of next increment under Rule 10 of CCS (Revised Pay) Rules 2016.

This HQrs is in receipt of references from some Controller Offices seeking clarification to certain points of doubt(s) in pursuance of MoF OM dated 28.11.2019 and 04.07.2023.

2. The matter has been examined in the light of extant provisions and clarification to the points referred have been summarised as appended below :

| Sr. No. | Points of doubt | Clarification |

| 1 | Whether the cases of promotion of MACP on or after 01 01.2016 onwards and beyond 28.11 2019 would be eligible for exercise/ re-exercise of under DoE O.M. dated 04.07.2023 | The opportunity to exercise/re-exercise option has been extended by MoF vide its OM dated 04.07.2023 to cover all employees promoted on or after 2016 upto 03.10.2023. |

| 2 | In cases where the personnel have already availed the opportunities for exercise/re-exercise of option as provided in the window by the DoE OM dated 15.04.2021, would also again be eligible to re-exercise the option under DoE dated 04.07.2023 ? | |

| 3 | Mof Order is silent about death case where the individual died before issue of this OM for exercise/re- exercise of option. Whether the benefit of pay fixation should be given in favour of the deceased employee or not. | As the MoF OMs do not allow any special dispensation for deceased employees, hence Grant of most beneficial option in respect of deceased employees may not be appropriate. |

This has the approval of CGDA.

(Roselin Tigga)

SAO (AT)

Comments